2024/12/24

01 Production

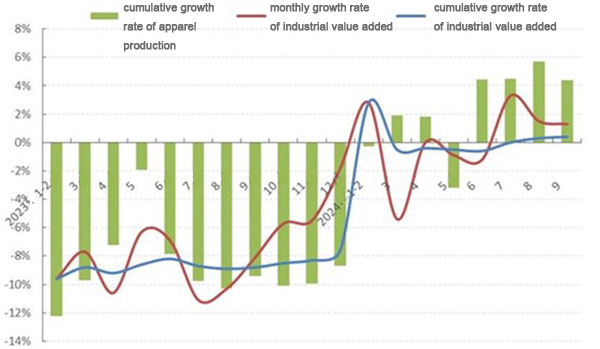

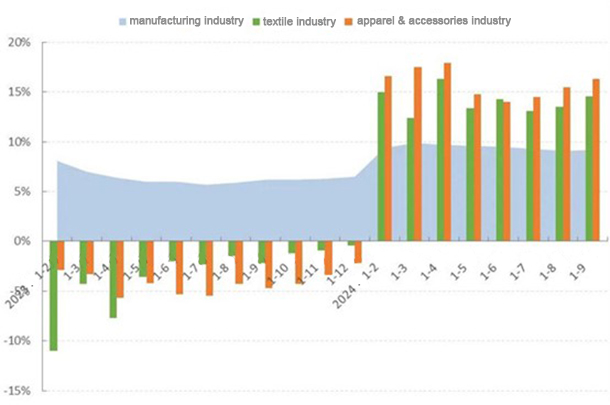

From January to September, driven by positive factors such as the gradual recovery of major international consumer markets and the increased demand for sportswear, the production of China’s apparel industry remained generally stable. According to the National Bureau of Statistics data, the industrial added value of apparel enterprises above the designated size increased by 0.4% year-on-year in the first three quarters, 9.2 percentage points higher than the same period of 2023.

Clothing production maintained growth. According to the National Bureau of Statistics, the garment output of enterprises above the designated size reached 15.15 billion pieces in the first three quarters, up by 4.41% year-on-year, 13.80 percentage points higher than the same period in 2023. From the perspective of subcategories, woven clothing output declined while knitted clothing production maintained faster growth. From January to September, knitted clothing production amounted to 10.42 billion pieces, which grew 7.45% year-on-year, accounting for 68.82% of the total apparel output, 2.47 percentage points higher than the proportion of the same period in 2023. And the output of woven garments was 4.72 billion pieces, declining by 1.73% year-on-year.

Figure 1: The Growth Rate of China’s Apparel Industry Production in Q1-Q3, 2024

Source: National Bureau of Statistics

02 Domestic Sales

Since the beginning of this year, China’s apparel domestic market has shown a sustained slowdown in growth. Into the third quarter, driven by the new round of stable growth policy measures and the summer economy boost, the domestic sales have improved, and the monthly decline gradually narrowed. In addition, the pulling effect of new modes of consumption, such as live e-commerce, short-video e-commerce, and instant retailing, was obvious. In the first three quarters, the online retail sales of wearable goods saw 4.1% year-on-year growth, 5.5 percentage points lower than the same period in 2023.

Figure 2: Sales of Clothing in the Chinese Market in Q1-Q3, 2024(Above the Designated Size)

Source: National Bureau of Statistics

03 Export

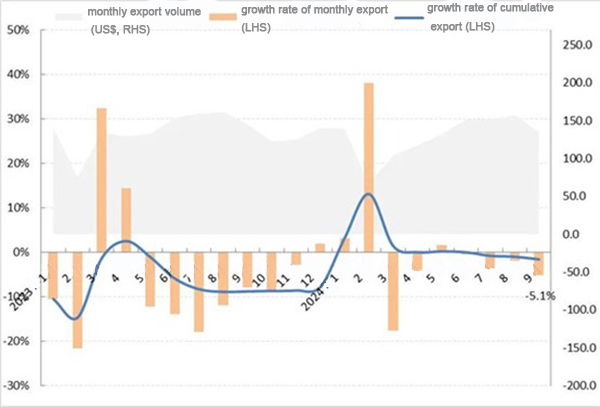

In the first three quarters, China’s clothing export scale was relatively stable. However, as part of the emerging market demand declined, export prices continued to fall and with the appreciation of the renminbi and other unfavorable factors, the industry faced increasing export pressure.

According to the Customs Newsletters, China’s apparel and accessories exports totaled US$ 118.11 billion in the first three quarters, decreasing by 1.6% year-on-year. From a monthly perspective, apparel exports started with a steady rise, but the pressure increased later. From the performance of export volume and price, the export volume increased while the average unit price decreased. The main reasons include that consumers are more inclined to purchase low-priced goods, while the proportion of cross-border e-commerce exports with a lower unit price has surged significantly.

Figure 3: The Performance of China’s Apparel and Accessories Exports in Q1-Q3, 2024

Source: China Customs

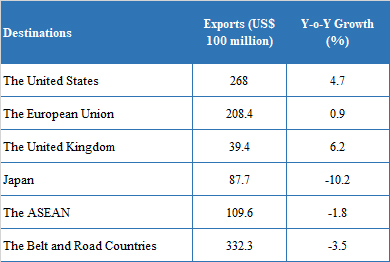

From the perspective of the major market, the export market witnessed an obvious diversification trend. China’s apparel exports to conventional markets showed resilience. Among them, the exports to the United States, the European Union and the United Kingdom grew year-on-year, and the decline rate of exports to Japan narrowed.

Table 1: China’s Apparel Exports by Destinations, Q1-Q3, 2024

Source: China Customs

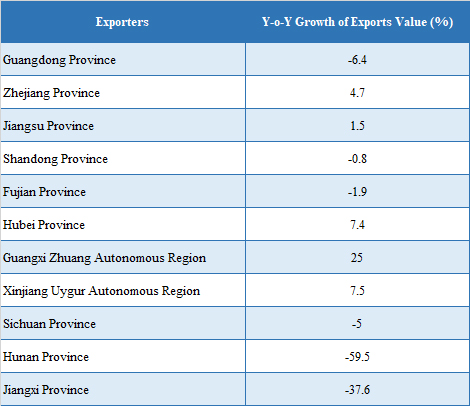

As for the exporting provinces, the main concentration area of China's apparel exports remained the eastern region; the central and western regions showed varied performance, of which the growth rate of apparel exports in Xinjiang slowed down significantly.

Table 2: Apparel Exports Performance of China’s Major Exporters, Q1-Q3, 2024

Source: China Customs

04 Benefit

In the first three quarters, China’s clothing enterprises maintained a recovered trend in their operation quality and efficiency. Affected by the lack of effective demand in the market and the intensified competition in the industry, the total profit has not yet reversed the negative growth trend, but the profitability of enterprises and the main operating indicators tend to improve.

According to the National Bureau of Statistics, from January to September, the main business income of apparel enterprises above the designated size totaled about 900 billion yuan, with a year-on-year growth of 1.02%, 9.15 percentage points higher than that of the same period last year. The total profit was 38.13 billion yuan, down by 2.62% year-on-year. The operating margin was 4.24%, 0.14 percentage points lower than that of 2023. 25.31% of apparel enterprises operated in deficit, which narrowed by 0.11 percentage points year-on-year. The turnover rate of finished products was 9.72 times/year, declining by 4.43% year-on-year; the turnover of accounts receivable was 5.79 times/year, seeing a year-on-year decrease of 4.46%; and the total asset turnover was 1.12 times/year, down by 1.92% year-on-year.

Figure 4: Main Economic Indicators of China’s Apparel Industry in Q1-Q3, 2024

Source: National Bureau of Statistics

05 Investment

Since the beginning of 2024, apparel enterprises have continued to deepen the transformation and upgrading, and actively expanded investment in intelligent production, business model innovation, brand building, channel layout, and other areas. Therefore, the fixed-asset investment in China’s garment industry maintained rapid growth.

According to the National Bureau of Statistics, the fixed-asset investment in China’s garment industry surged by 16.3% year-on-year in the first three quarters this year, 21.0 percentage points higher than the same period last year.

Figure 5: Fixed-asset Investment in China’s Textile Industry, Q1-Q3, 2024

Source: National Bureau of Statistics

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay