2024/12/24

China’s gross domestic product (GDP) grew by 4.8% year-on-year in the first three quarters of 2024, presenting stable economic performance. The chemical fiber industry also presented a recovered growth trend. Under the slowdown in new production capacity, production achieved a 9.53% growth; the inventory pressure can be controlled dynamically; the industry’s economic efficiency saw year-on-year growth, but the profit growth has gradually narrowed; the significant drop of polyester filament exports to India dragged down the overall exports of chemical fibers.

I.Production & Inventory

In the first three quarters, China’s chemical fiber industry load was relatively high, which was higher than the same period last year. In March and April, downstream demand performed better than expected, and the operating capacity of most of the subsectors of the chemical fiber industry stayed at a high level during the same period in recent years. However, the high start-up caused the accumulation of inventories and narrowed benefits, part of the polyester enterprises even witnessed losses; combined with the weakened demand in the off-season, the polyester start-up load declined from June to August. In September, the increased downstream operating rate promoted a slight rise in the chemical fiber industry start-up load, which maintained a high level in October. By the end of October, the operating capacity of polyester filament has been raised to 93%. While the polyamide filament has been maintained at more than 90% thanks to the steady development of production capacity, and increased application demand in some areas.

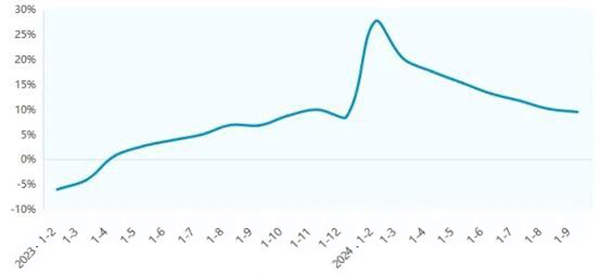

According to the National Bureau of Statistics, the chemical fiber output totaled 58.6 million tons in the first three quarters of 2024, seeing a year-on-year growth of 9.53% (Figure 1).

Figure 1: The Growth rate of Chemical Fibers Output from the Beginning of 2023

Source: National Bureau of Statistics, China Chemical Fibers Association (CCFA)

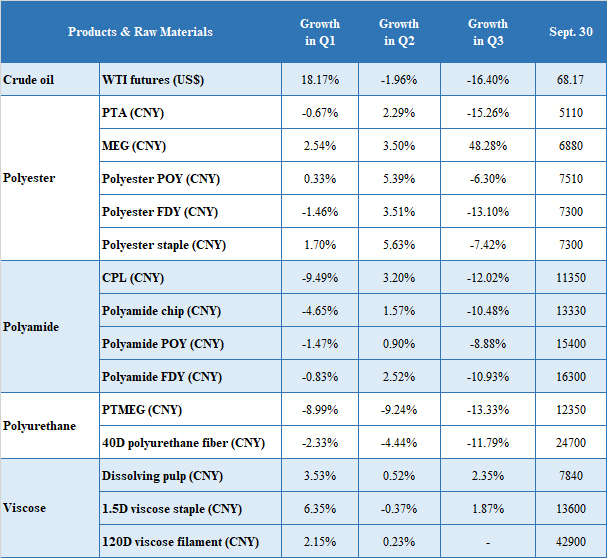

II. Market & Price

By sub-industry, polyester-related and polyamide-related raw materials fell obviously in the third quarter; polyurethane-related raw materials were in a downward trend; viscose fiber industry chain performed better, showing a slight upward trend (Table 1).

Table 1: Price Change of Main Chemical Fibers and Raw Materials

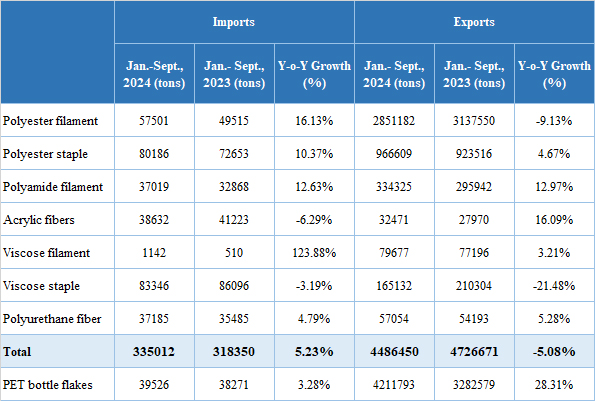

III. Foreign Trade

According to China Customs data, the exports of major chemical fiber products fell 5.08% year-on-year in the first three quarters. By sub-products, polyester filament exports declined by 9.13% year-on-year, which was dragged by the sharp export decrease to India. In addition, the decline of exports to Turkey ranked second only to India, which was mostly due to reduced demand. Early this year, Turkey put into production a set of polyester plants with 300,000 tons production capacity per year; among which, 250,000 tons are used for POY and DTY production, and the remaining 50,000 tons for the production of polyester chips. In the second and third quarters, the export performance of polyester staple and polyamide filament saw year-on-year growth of 4.67%, and 12.97%, respectively, in the first three quarters. Acrylic fiber exports maintained the growth trend, but its growth rate gradually narrowed. Viscose staple exports dropped by 21.48% year-on-year, this is mainly because the international purchase price is less than the price of the domestic sales, and Chinese enterprises tend to expand the domestic market.

Table 2: Foreign Trade of Chemical Fiber Products in the First Three Quarters of 2024

Source: Based on data from China Customs

From the perspective of export destinations, the export market share of chemical fiber changed significantly. The exports to Vietnam accounted for 11.6% in the first three quarters, 2.2 percentage points higher than last year’s annual increase; exports to India accounted for 4.9%, seeing a 5.9 percentage points decline compared with last year’s performance. And the exports to Turkey accounted for 7.5%, 2.2 percentage points lower than that of last year.

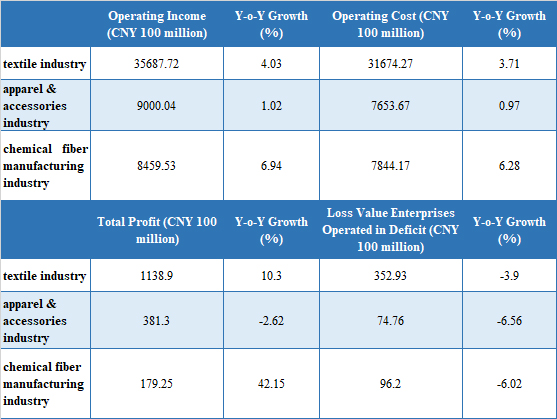

IV. Revenue & Benefits

According to the National Bureau of Statistics data, the operating revenue of China’s chemical fiber industry totaled 845.95 billion yuan in the first three quarters, seeing a year-on-year increase of 6.94%. Their total profit reached 17.92 billion yuan, surging by 42.15% year-on-year. The base effect narrower the profit growth gradually. By sub-industry, polyester fiber, polyamide fiber, and spandex contributed 35%, 21%, and 3% of the total profit, respectively.

Table 3: Economic Benefit of Chemical Fiber and Related Industries in Q1-Q3, 2024

Source: National Bureau of Statistics

V. Fixed-assets Investment

According to the National Bureau of Statistics, the fixed-assets investment in the chemical fiber industry increased by 4.7% year-on-year in the first three quarters, while this figure was -11.6% in the same period in 2023. The investment growth rate rebounded under the low base effect. From the perspective of new production capacity, the new capacity of polyester fibers reached 1.16 million tons/year; PET bottle flakes were still in the expansion cycle, with a new capacity of 3.42 million tons/year and 2.3 million tons/year to be invested.

Figure 2: Fixed-Assets Investment Growth of the Chemical Fiber Industry from 2008 to Jan.-Sept., 2024

Source: National Bureau of Statistics

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay