2024/11/20

Situation Overview

In the first three quarters, China’s economic fundamentals remain stabilized and improving. Based on preliminary accounting, China’s GDP reached 94.97 trillion in the first three quarters, seeing a year-on-year growth of 4.8%. National goods foreign trade totaled US$ 4.55 trillion, up by 3.5% year-on-year. among which, exports amounted to US$ 2.62 trillion, up by 4.5% year-on-year. The foreign trade in textiles and apparel in the first three quarters amounted to US$ 238.55 billion, up 0.5% year-on-year, of which exports amounted to US$ 222.77 billion, up 0.6% year-on-year.

In the first half of 2024, driven by the gradual stabilization of the domestic economy, the rebound in the demand from key markets, and the lower base, China’s textile and apparel exports rebounded steadily. In US$-denominated terms, the overall exports in the first half of the year increased by 1.6% year-on-year. In the third quarter, affected by the continued decline in export prices, extreme weather, and the fall in demand in some emerging markets, the exports saw a first-time decline in the year, of which a decline of 3.8% in September.

Looking ahead to the fourth quarter, it is expected that textile and apparel exports will continue the trend of the third quarter as a whole. On the positive side, global trade is in the process of recovery. International organizations generally predict that global trade demand in 2025 will maintain the growth trend. WTO’s latest forecast shows that global trade in goods will grow by 2.7% in 2024, slightly higher than the previous forecast of 2.6%; and that 2025 will maintain the recovery trend. Currently, global inflation is generally moderating. “World Economic Outlook” released by the International Monetary Fund, said that a peak was reached in the third quarter of 2022 (9.4%); the global inflation rate by the end of 2025 is expected to fall from an annual average of 5.8% in 2024 to 3.5%. The United States and European markets have recently rebounded, which may not fluctuate significantly by the end of the year. A round of policies stimulus in China has been introduced one after another. Proactive monetary and fiscal policies will improve the macro fundamentals, boosting the confidence of enterprises, and further stabilizing the expectations.

On the negative side, the U.S. election, geopolitical changes and exchange rate fluctuations will pose uncertainties on the future of enterprises. Unstable demand from the emerging market coupled with the higher export base at the end of last year become the constraints of whether the growth trend can be maintained or not, bringing greater uncertainty to the export and profitability of enterprises.

Trade Data

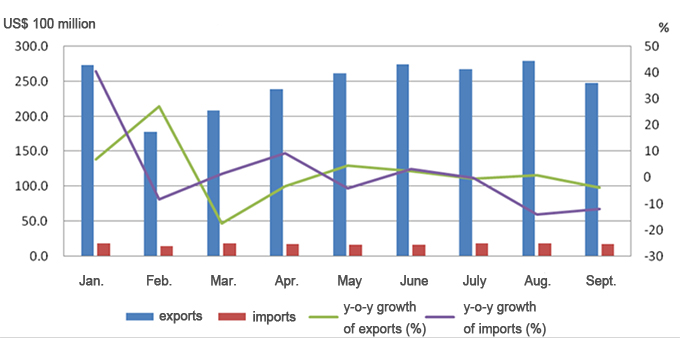

From January to September, the foreign trade of textile and apparel totaled US$ 238.55 billion, up by 0.5% year-on-year. Thereinto, exports reached US$ 222.77 billion, seeing a slight increase of 0.6%; imports totaled US$ 15.79 billion, seeing a decline of 1.1%.

In September, the textile and apparel trade volume totaled US$ 26.52 billion, down by 4.4% year-on-year, of which exports were US$ 24.78 billion, down by 3.8%, and imports were US$ 1.75 billion, declining by 12.2%.

Figure 1: Foreign Trade of China’s Textile and Apparel in Q1-Q3

Market Analysis

In September, textile and apparel exports failed to maintain the weak growth trend in the case of last year’s low base, down by 3.8% year-on-year. Negative export growth is mainly dragged down by apparel performance, it saw a cumulative decline of 3.5% in the third quarter, which fell by 5.1% in September, and there is no sign of recovery.

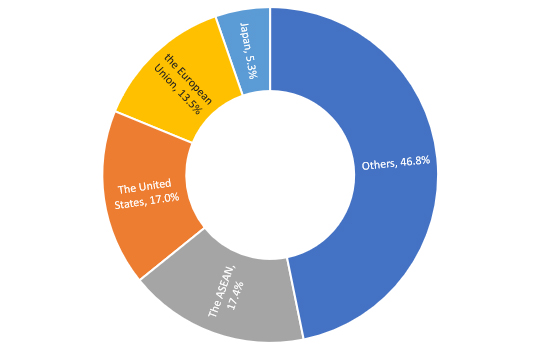

In September, among the four traditional markets, i.e., ASEAN, the United States, the European Union, and Japan, China’s exports to the United States and the European Union increased by 8% and 0.1%, respectively, to ASEAN and Japan fell by 4.8% and 18.5%. Total exports to the four traditional markets reached US$ 12.95 billion, accounting for 52.3% of the total exports in September. Affected by the high base of the same period last year and the difficulty of Russia’s export settlement and other factors, China’s exports to Russia and Kazakhstan appeared to be a substantial pullback in September.

From the perspective of total exports in the first three quarters, China’s exports to ASEAN, the United States, and the European Union maintained year-on-year growth, up by 6.1%, 5.7%, and 2% respectively. Exports to Japan declined continually, down by 9.9% year-on-year. In the first three quarters of this year, exports to the above four traditional markets totaled US$ 118.51 billion, accounting for 53.2% of the total exports. Exports to the 152 “Belt and Road” countries amounted to US$ 118.55 billion, seeing a year-on-year decline of 0.4%.

Figure 2: China’s Textile and Apparel Exports by Market Share in Q1-Q3 2024

(A)China’s textile and apparel exports to the United States rose 5.7% in the first three quarters

Data released by the U.S. Bureau of Labor Statistics showed that the U.S. nonfarm payrolls increased by 254,000 in September, marking the largest monthly increase since March. The U.S. unemployment rate fell for the second consecutive month in September to 4.1%. The Federal Reserve cut interest rates by 50 basis points at its September interest rate meeting, kicking off a cycle of monetary easing while promising further rate cuts. This decision reflects the FED’s growing confidence in achieving its economic goals.

From January to September, China’s textile and apparel exports to the United States amounted to US$ 37.78 billion, up by 5.7% year-on-year. Among them, the exports of knitted and woven apparel totaled US$ 23.26 billion, up by 4.6% year-on-year; the export volume increased by 15.1% year-on-year, and the export unit price fell by 9.1%.

In September, China’s textile and apparel exports to the United States reached US$ 4.57 billion, seeing an increase of 8% year-on-year, 2 percentage points higher than the previous month. The exports of knitted and woven apparel amounted to US$ 2.82 billion, up by 11.3% year-on-year.

According to the U.S. import data, the United States imported US$ 11.53 billion worth of textile and apparel from the world in August, up by 1.8% year-on-year. Imports from China surged by 10%, from Vietnam increased by 3.1%, and from India and Bangladesh fell by 0.3%, and 0.6% respectively. And the share of China, Vietnam, India and Bangladesh accounted for 29.9%, 14.3%, 7.4% and 5.6% respectively.

(B)China’s textile and apparel exports to ASEAN grew by 6.1% in the first three quarters

ASEAN’s economic situation showed a solid recovery trend. The recovery in Vietnam, Cambodia and other ASEAN countries boosted China’s textile exports. In the first three quarters, China exported US$ 38.82 billion worth of textiles and apparel to ASEAN, up by 6.1% year-on-year. That to Vietnam was US$ 13.5 billion, seeing an increase of 6.5% year-on-year; exports to Malaysia reached US$ 4.87 billion, up by 0.3% year-on-year; that to Cambodia amounted to US$ 4.39 billion, ballooning by 31.7% year-on-year. By category, China exported US$ 20.27 billion worth of yarn and fabrics to ASEAN, increasing by 10.8% year-on-year; apparel exports reached US$ 10.99 billion, declining by 1.5% year-on-year In September, China exported US$ 3.89 billion worth of textile and apparel to ASEAN, decreasing by 4.8% year-on-year.

(C)Exports to the EU maintained a slight increase in September

Economic recovery in the European Union is weak. The latest report released by the International Monetary Fund (IMF) expects that the EU economy will grow by 0.8% and 1.2% this year and next year, which is 0.1 and 0.3 percentage points lower than the prediction of three months ago. From January to September, China exported US$ 30.09 billion worth of textile and apparel to the EU, up by 2% year-on-year. From the perspective of exported countries, exports to Germany, Spain, the Netherlands and Poland increased more. In September, China’s textile and apparel exports to these four countries were US$ 500 million, US$ 440 million, US$ 390 million and US$ 260 million, respectively, seeing an increase of 9.6%, 2%, 4.5% and 12.3% year-on-year.

(D)Exports volume and price to Japan both saw the decline

Japan’s economic recovery has been weak due to the decline in inbound travelers, weakening foreign trade performance, and high inflation. From January to September, China’s textile and apparel exports to Japan amounted to US$ 11.82 billion, declining by 9.9% year-on-year.

In September alone, China exported US$ 1.6 billion worth of textile and apparel to Japan, down by 18.5% year-on-year, which saw 17 consecutive months of year-on-year decline since May 2023. Unlike the European and American markets, China’s exports to Europe and the United States saw a rise in volume and a price decline. The drop in exports amount was caused by price decline. While exports to Japan saw declines in both volume and price, and the decrease in export volume was greater than the decline in the average price of exports.

(E) Exports to the “Belt and Road” countries fell back in September

In September, China exported US$ 12.69 billion worth of textile and apparel to 152 “Belt and Road” countries, seeing a year-on-year decline of 5.8%. Among them, exports to Russia amounted to US$ 520 million, down by 9% year-on-year; exports to Kazakhstan reached US$ 570 million, slumping by 20.5% year-on-year; exports to Kyrgyzstan were US$ 850 million, up by 7.6% year-on-year; exports to Uzbekistan increased by 2.3%. While that to Saudi Arabia, the UAE and Egypt decreased by 20%, 5% and 13% respectively.

From January to September, China’s textile and garment exports to the “Belt and Road” countries totaled US$ 118.55 billion, seeing a slight decrease of 0.4% year-on-year.

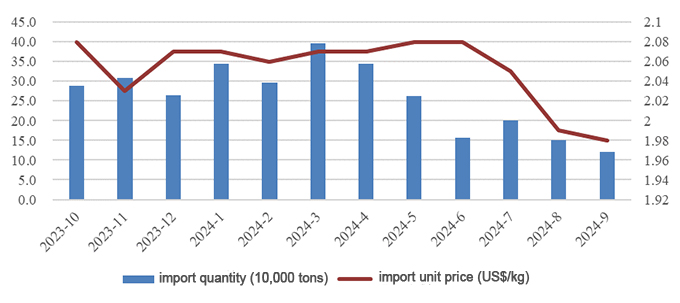

Cotton Performance

According to the China Cotton Association, the Central Politburo held an important meeting to accelerate the launch of a package of incremental policies in September, which greatly enhanced market confidence, and stimulated market vitality. The downstream demand for the cotton textile industry maintained the recovered trend; raw material inventories, and finished product inventories all declined. Driven by the domestic macroeconomic and improvement in the industrial situation, cotton prices in China continued to rise, and the price difference between domestic and foreign cotton narrowed. In September, China’s cotton imports saw a sharp decline in both year-on-year growth and month-on-month growth. China imported 120,000 tons of cotton in September, slumping by 20% month-on-month and 50.3% year-on-year. Among the main source countries of imports, Australian cotton accounted for 53%, ranked first; the United States cotton ranked second, accounting for 21%. From January to September, China’s cotton imports totaled 2.27 million tons, seeing an increase of 1.1 times year-on-year, the average import price was US$ 2059 per ton. As for the chemical fiber imports, its import volume increased by 13.5% year-on-year while the average import price decreased by 4.8% in September.

Figure 3: Monthly Cotton Import Volume and Price Trends from October 2023 to September 2024

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay