2024/1/4

Since 2023, the printing and dyeing sector in China has encountered a more intricate and arduous landscape, presenting itself both domestically and abroad. The escalating global geopolitical risk is having a direct impact on the efficiency of the industrial and supply chain. The implementation of stringent monetary measures by the United States and Europe, along with other advanced economies, has resulted in a rise in downward pressure on the global economy, leading to a decline in overall external demand. The primary contradiction in the present economic operation remains the deficiency of domestic demand and consumer confidence. During the first three quarters, the printing and dyeing sector has maintained a steady production status, recording a marginal rise in dyed fabric output. However, their growth rate has decreased in comparison to the first half of the year. The exports in major printed and dyed products have shown a decrease in volume and price, amplifying the diversification of the export market and driving down the average unit price of exports. The principal economic measures persist in indicating a favorable trajectory, as the decline rate steadily decreases and mitigates the strain on enterprise performance.

I. Production

The data released by the National Bureau of Statistics revealed that the output of printed and dyed fabrics above the designated size in the printing and dyeing industry totaled 40.97 billion meters in the first three quarters of 2023, up by 0.84% year-on-year, 0.82 percentage points lower than that of the first quarter.

From the perspective of monthly output, affected by the weak consumption demand for textiles and apparel, the output of printed and dyed cloth all maintained at less than 5 billion meters in the July to September period. The printing and dyeing industry is facing a shortage of terminal demand, leading to a decrease in production orders and a maintained low capacity utilization rate, causing ongoing pressure on the industry’s production.

Figure 1: Printed and Dyed Fabrics Output of Enterprises Above Designated Size in China in Q1-Q3, 2023

Source: National Bureau of Statistics

II. Operation quality and efficiency

Due to inadequate demand, intricate domestic and international circumstances, and additional variables, the operational standards of the printing and dyeing sector have deteriorated, and the recovery of operational effectiveness has been sluggish.

According to the data from the National Bureau of Statistics, from January to September, the share of three overheads in turnover was 6.93%, up 0.26 percentage points year-on-year. The turnover rate of finished products was 13.90 times/year, down 10.70% year-on-year; the turnover of accounts receivable was 8.09 times/year, seeing a year-on-year decline of 0.29%; and the total asset turnover was 0.95 times/year, down 2.09% year-on-year.

The data from the National Bureau of Statistics showed that the operating income of China’s printing and dyeing enterprises above the designated size totaled CNY 216.03 billion in the first three quarters, seeing a year-on-year decrease of 0.90%, 2.38 percentage points narrower than that of the first half. Their profits totaled CNY 7.43 billion, down by 12.23% year-on-year, 12.11 percentage points narrower than that of the first half. Its ratio of profits to cost was 3.66%, up by 0.61 percentage points year-on-year. The sales profit margin was 3.44%, 0.55 percentage points higher than the first half. 35.46% of printing and dyeing enterprises operated in deficit with CNY 2.8 billion of loss value, which increased by 9.63% year-on-year. But the growth rate narrowed by 14.60 percentage points.

Within the third quarter, the implementation of several governmental initiatives designed to stabilize growth and bolster consumption resulted in a continuous improvement in the operational proficiency of the printing and dyeing domain. The business income and total profit of the printing and dyeing enterprise above the designated size have experienced a downward trend, yet the rate of decline has been gradually attenuated. Alongside this, the industry has seen an increase in its sales profit margin, resulting in an improved operation for the enterprise.

Figure 2: Main Economic Indicators of the Printing and Dyeing Enterprises Above the Designated Size in Q1-Q3

Source: National Bureau of Statistics

III. Exports

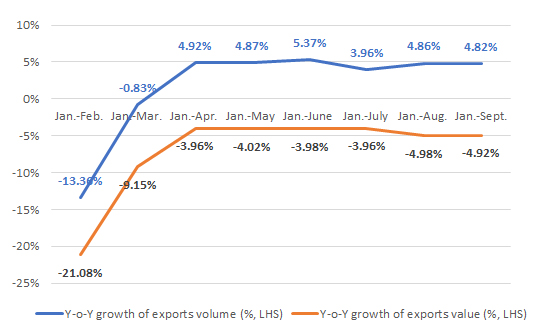

According to the statistics released by China General Customs, the export volume of eight major categories of printed and dyed products, i.e., dyed cotton fabric, printed cotton fabric, dyed cotton-blended fabric, printed cotton-blended fabric, synthetic filament fabric, polyester staple fabric, printed and dyed T/C fabric, man-made staple fabric, totaled 23.61 billion meters in the first three quarters of this year, up by 4.82% year-on-year, 0.55 percentage points lower than that of the first half this year. While the export value reached US$ 22.72 billion, seeing a year-on-year decline of 4.92%, 0.90 percentage points higher than that of the first half. And the average export unit price was US$ 0.96/meter, declining by 9.29% year-on-year.

Figure 3: The Export Growth Rate of Eight Major Categories of Printed and Dyed Products in China in Q1-Q3, 2023

Source: China Customs

Among the main export destinations, the export volume of China’s eight major categories of printed and dyed products to ASEAN countries reached 5.26 billion meters in the first three quarters, seeing a year-on-year increase of 0.97%. That of the RCEP trading partner countries totaled 5.65 billion meters, up by 0.35% year-on-year.

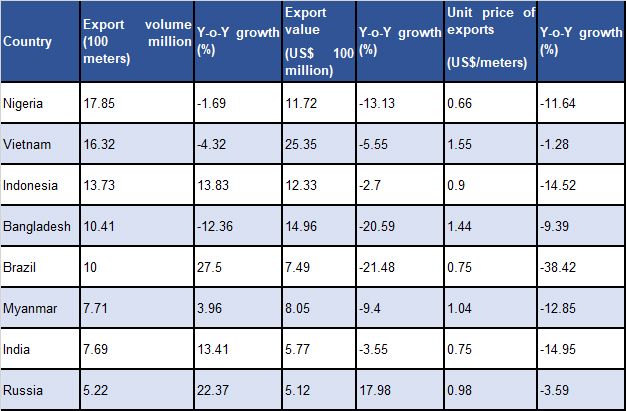

From the perspective of the major export countries, the export market of China’s printing and dyeing industry has become more diversified. Vietnam and Bangladesh, two major exporters of apparel on the global stage, share a significant reliance on China’s printed and dyed fabric. In light of the contracted demand in Europe and the United States, the demand for printed and dyed fabric from Vietnam and Bangladesh has experienced a decline during the first three quarters of this year; while the rapid surge in demand from Indonesia, Brazil, India, and Russia has played a crucial role in propelling the export scale of China’s printing and dyeing trade.

Table: Performance of Part Destinations of China’s Eight Major Categories of Printed and Dyed Products in Q1-Q3, 2023

Source: China Customs

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay